Diversified Port Property Experience

Since its founding in 2003, Aegir’s founding principal, Franc J Pigna, has continuously researched, analysed and written on numerous aspects of port real estate and how it impacts ports and their clients.

From writing the seminal research paper on the subject for the American Association of Port Authorities, to numerous presentations at international industry conferences, writing papers for trade journals and being published in books related to ports, infrastructure finance and other relevant topics, research and innovation form a major cornerstone for providing innovative service. Aegir’s principals and consultants have a wide breadth and scope of port real estate experience and service delivery worldwide, best exemplified with the cross section of instructions below.

Case: Port land portfolio analysis and lease structuring

Location: Quebec Province, Canada

Challenge: Over the years, the POS had assembled over 3,000 acres of land to expand the port to meet demand from heavy mining companies in the region wanting port access. Being in a remote area, the challenge was to develop a lease model that would produce lease rates representing fair market values for rent for this type of port land. Based on the highly specialised nature of the use and the existing dearth of true like kind properties in the area, a national survey had to be conducted. The lease rate, methodology and substantiation of the rent had to be easily understood by potential tenants. It was expected that the land bank would be taken up by just four tenants.

Solution: Undertake a valuation of the land as port property and develop a lease model that would determine appropriate lease rates, by, amongst other things, conducting a national sway of similar property and uses. The model was meant to be used by port staff, use defendable methodology, produce results that would be highly substantiated by market data, and be easily understood by potential tenants.

The Net Results: We were informed that the port was achieving rents that were producing real returns of and on capital invested and were being accepted by the market.

Case: Port land portfolio analysis and lease structuring

Location: Quebec Province, Canada

Challenge: Over the years, the POS had assembled over 3,000 acres of land to expand the port to meet demand from heavy mining companies in the region wanting port access. Being in a remote area, the challenge was to develop a lease model that would produce lease rates representing fair market values for rent for this type of port land. Based on the highly specialised nature of the use and the existing dearth of true like kind properties in the area, a national survey had to be conducted. The lease rate, methodology and substantiation of the rent had to be easily understood by potential tenants. It was expected that the land bank would be taken up by just four tenants.

Solution: Undertake a valuation of the land as port property and develop a lease model that would determine appropriate lease rates, by, amongst other things, conducting a national sway of similar property and uses. The model was meant to be used by port staff, use defendable methodology, produce results that would be highly substantiated by market data, and be easily understood by potential tenants.

The Net Results: We were informed that the port was achieving rents that were producing real returns of and on capital invested and were being accepted by the market.

Case: On and off port ground lease reviews

Location: California, USA

Challenge: A major tract of near dock land behind a terminal and a large port owned industrial tract located off port but under a port related use were coming up for rent review. The port director felt current rental rates for both sites were well below ‘market’ but had no way of gauging this locally.

Solution: Aegir was engaged to undertake a comprehensive assessment of the two sites, the general market conditions for industrial land in the region and land at comparable port facilities and uses and determine what the ‘market’ rents should be for both.

The net results: Through a combination of in depth local and like kind port market and property analyses and using established valuation approaches and methodologies developed by Aegir, market values and corresponding lease rates were established and corroborated resulting in lease rates more than fifty percent of the existing ones.

Case: On and off port ground lease reviews

Location: California, USA

Challenge: A major tract of near dock land behind a terminal and a large port owned industrial tract located off port but under a port related use were coming up for rent review. The port director felt current rental rates for both sites were well below ‘market’ but had no way of gauging this locally.

Solution: Aegir was engaged to undertake a comprehensive assessment of the two sites, the general market conditions for industrial land in the region and land at comparable port facilities and uses and determine what the ‘market’ rents should be for both.

The net results: Through a combination of in depth local and like kind port market and property analyses and using established valuation approaches and methodologies developed by Aegir, market values and corresponding lease rates were established and corroborated resulting in lease rates more than fifty percent of the existing ones.

Case: Port property strategic asset management plan and port pricing

Location: Cayman Islands

Challenge: Port Authority of Cayman Islands’ revenues were not keeping up with expense and future infrastructure investment requirements. Recently, government transferred the pension liabilities to the port authority as well, resulting in major accounting losses.

Solution: comprehensive analysis of the port’s assets, business model and revenue streams; creation of an internal port valuation model and lease model; rationalisation of non-port related assets; and scheduling of rate increases using regulatory pricing modelling and structuring to accomplish the goal of profitability and financial self-sustainability.

The Net Results: model will soon be implemented..

Case: Port property strategic asset management plan and port pricing

Location: Cayman Islands

Challenge: Port Authority of Cayman Islands’ revenues were not keeping up with expense and future infrastructure investment requirements. Recently, government transferred the pension liabilities to the port authority as well, resulting in major accounting losses.

Solution: comprehensive analysis of the port’s assets, business model and revenue streams; creation of an internal port valuation model and lease model; rationalisation of non-port related assets; and scheduling of rate increases using regulatory pricing modelling and structuring to accomplish the goal of profitability and financial self-sustainability.

The Net Results: model will soon be implemented..

Case: Valuation and expert witness - semi-automated port facility

Location: Portsmouth, Virginia

Challenge: During the instruction, Virginia International Gateway was one of four semi-automated container terminals in North America. It was built in 2007 by APM Terminals, a subsidiary of Maersk, and is the largest, privately owned terminal in the US. In 2010, the Virginia Port Authority entered a 20-year lease for the terminal with APMT. In 2014, APMT sold the terminal to an infrastructure fund that entered a 49-year concession for the terminal with VPA. As a privately owned terminal, it pays property taxes to the City of Portsmouth. In 2016, the infrastructure fund sues the City of Portsmouth for wrongly assessing the facility at or around $330 million as being overvalued. Aegir was retained as the lead port property consultant and assisted in setting up the team of professionals that would value the terminal facility in the city’s defense case.

Solution: By following a comprehensive process following a logical path, with each step being fully substantiated, a comprehensive valuation was developed that would assist the legal team defend the assessed value the city had determined for the terminal facility (in fact, the value conclusion in the report was significantly higher than the assessed value using both the income and replacement cost approaches).

The Net Results: The attorneys representing the city were successful in defending the assessed value.

Case: Valuation and expert witness - semi-automated port facility

Location: Portsmouth, Virginia

Challenge: During the instruction, Virginia International Gateway was one of four semi-automated container terminals in North America. It was built in 2007 by APM Terminals, a subsidiary of Maersk, and is the largest, privately owned terminal in the US. In 2010, the Virginia Port Authority entered a 20-year lease for the terminal with APMT. In 2014, APMT sold the terminal to an infrastructure fund that entered a 49-year concession for the terminal with VPA. As a privately owned terminal, it pays property taxes to the City of Portsmouth. In 2016, the infrastructure fund sues the City of Portsmouth for wrongly assessing the facility at or around $330 million as being overvalued. Aegir was retained as the lead port property consultant and assisted in setting up the team of professionals that would value the terminal facility in the city’s defense case.

Solution: By following a comprehensive process following a logical path, with each step being fully substantiated, a comprehensive valuation was developed that would assist the legal team defend the assessed value the city had determined for the terminal facility (in fact, the value conclusion in the report was significantly higher than the assessed value using both the income and replacement cost approaches).

The Net Results: The attorneys representing the city were successful in defending the assessed value.

Case: Master plan - strategic port property plan for 1,000-acre industrial port property portfolio

Location: New Orleans, USA

Challenge: The Port of New Orleans was undertaking a master plan of the port. The port desired a strategic port property plan for a 1,000-acre industrial waterfront property portfolio undertaken as part of the master plan. This portfolio is commonly known as the Industrial Canal District and had been underdeveloped and underutilised for decades. The Industrial Canal is the water connection between Lake Pontchartrain and the Mississippi River. Additionally, the port also controls most of the industrial waterfront in New Orleans. As such, it is the effective ‘market maker’ for rent for this type of property. As the Industrial Canal had been underdeveloped and underutilised and poorly maintained it had historically experienced high vacancy rates. Consequently, the rents found in the area were not representative of what industrial waterfront land in the proximity of a deep-water port should be leasing for. Part of the problem was also the result of the other industrial waterfront properties using the Industrial Canal ground rents as benchmarks by the port.

Solution: Aegir conducted a regional assessment of large port related, waterfront industrial land along with the potential for cargo types that could be handled in New Orleans with this type of land bank. Aegir also developed a comprehensive strategic port property plan that identified the strengths/weaknesses/opportunities/threats as an intermodal, shallow/deep-water industrial logistics platform; made recommendations for the repair, management and enhancement of the common areas and individual sites to make and security of the area to make it more competitive from a leasing standpoint; developed a lease model based on identifying a baseline value for waterfront industrial land along with the added value of the marine infrastructure in place to form the basis for developing a ground lease rate model, along with the requisite terms and conditions; areas on how to better integrate the area with overall port operations; and developed financial targets to achieve for the port to benchmark its performance in the management of the re-positioned Industrial Canal District.

The Net Results: The Port Authority had a well-defined road map with which to optimally incorporate the land portfolio into its mainstream operations—one that would also increase revenue streams and enhance the overall value of the port. This was the first time that this portfolio had been assessed relative to the local industrial property market; the regional port property market; and as an integrated, strategic port asset.

Case: Master plan - strategic port property plan for 1,000-acre industrial port property portfolio

Location: New Orleans, USA

Challenge: The Port of New Orleans was undertaking a master plan of the port. The port desired a strategic port property plan for a 1,000-acre industrial waterfront property portfolio undertaken as part of the master plan. This portfolio is commonly known as the Industrial Canal District and had been underdeveloped and underutilised for decades. The Industrial Canal is the water connection between Lake Pontchartrain and the Mississippi River. Additionally, the port also controls most of the industrial waterfront in New Orleans. As such, it is the effective ‘market maker’ for rent for this type of property. As the Industrial Canal had been underdeveloped and underutilised and poorly maintained it had historically experienced high vacancy rates. Consequently, the rents found in the area were not representative of what industrial waterfront land in the proximity of a deep-water port should be leasing for. Part of the problem was also the result of the other industrial waterfront properties using the Industrial Canal ground rents as benchmarks by the port.

Solution: Aegir conducted a regional assessment of large port related, waterfront industrial land along with the potential for cargo types that could be handled in New Orleans with this type of land bank. Aegir also developed a comprehensive strategic port property plan that identified the strengths/weaknesses/opportunities/threats as an intermodal, shallow/deep-water industrial logistics platform; made recommendations for the repair, management and enhancement of the common areas and individual sites to make and security of the area to make it more competitive from a leasing standpoint; developed a lease model based on identifying a baseline value for waterfront industrial land along with the added value of the marine infrastructure in place to form the basis for developing a ground lease rate model, along with the requisite terms and conditions; areas on how to better integrate the area with overall port operations; and developed financial targets to achieve for the port to benchmark its performance in the management of the re-positioned Industrial Canal District.

The Net Results: The Port Authority had a well-defined road map with which to optimally incorporate the land portfolio into its mainstream operations—one that would also increase revenue streams and enhance the overall value of the port. This was the first time that this portfolio had been assessed relative to the local industrial property market; the regional port property market; and as an integrated, strategic port asset.

Case: Master plan - strategic port property plan for 1,000-acre industrial port property portfolio

Location: New Orleans, USA

Challenge: The Port of New Orleans was undertaking a master plan of the port. The port desired a strategic port property plan for a 1,000-acre industrial waterfront property portfolio undertaken as part of the master plan. This portfolio is commonly known as the Industrial Canal District and had been underdeveloped and underutilised for decades. The Industrial Canal is the water connection between Lake Pontchartrain and the Mississippi River. Additionally, the port also controls most of the industrial waterfront in New Orleans. As such, it is the effective ‘market maker’ for rent for this type of property. As the Industrial Canal had been underdeveloped and underutilised and poorly maintained it had historically experienced high vacancy rates. Consequently, the rents found in the area were not representative of what industrial waterfront land in the proximity of a deep-water port should be leasing for. Part of the problem was also the result of the other industrial waterfront properties using the Industrial Canal ground rents as benchmarks by the port.

Solution: Aegir conducted a regional assessment of large port related, waterfront industrial land along with the potential for cargo types that could be handled in New Orleans with this type of land bank. Aegir also developed a comprehensive strategic port property plan that identified the strengths/weaknesses/opportunities/threats as an intermodal, shallow/deep-water industrial logistics platform; made recommendations for the repair, management and enhancement of the common areas and individual sites to make and security of the area to make it more competitive from a leasing standpoint; developed a lease model based on identifying a baseline value for waterfront industrial land along with the added value of the marine infrastructure in place to form the basis for developing a ground lease rate model, along with the requisite terms and conditions; areas on how to better integrate the area with overall port operations; and developed financial targets to achieve for the port to benchmark its performance in the management of the re-positioned Industrial Canal District.

The Net Results: The Port Authority had a well-defined road map with which to optimally incorporate the land portfolio into its mainstream operations—one that would also increase revenue streams and enhance the overall value of the port. This was the first time that this portfolio had been assessed relative to the local industrial property market; the regional port property market; and as an integrated, strategic port asset.

Case: Cruise terminal feasibility analysis

Location: Texas, USA

Challenge: The port is one of the two largest energy ports in the country. Interested in diversifying its revenue streams, the Port of Corpus Christi desired to have a feasibility analysis for the development of a cruise terminals at two specific sites within the Corpus Christi harbour area.

Solution: A comprehensive assessment of the Gulf Coast cruise market and its dynamics was conducted, along with a financial analysis of potential revenue streams that this might generate. The cruise market analysis included analysing of the requisite transportation infrastructure for passengers, potential market catchment areas, and existing port-of-calls and home ports in the Gulf of Mexico, along with potential cruise line requirements and future cruise ship sizes and average fleet growth to determine the potential for home porting at Corpus Christi. The feasibility study also included a return/risk analysis and forecast of revenues compared to potential development costs measured against existing cargo types.

The Net Results: The port received a comprehensive assessment of all factors related to determining the potential financial, market, and stakeholder returns for a potential cruise terminal benchmarked against pre-determined industry and internal target thresholds. The net result of the analysis was that the market catchment area would not support a home port for a ship of any significant size, the access to the potential cruise terminal facility was not adequate (air, road), and the existing cruise terminals in the Gulf of Mexico represented existing and future passenger and terminal capacity represented a significant degree of competition (ie, Galveston, New Orleans, Mobile, Tampa) that would make a cruise terminal at Corpus Christi financially infeasible and far too risk laden, particularly when compared to the revenue streams generated by liquid bulk energy cargo.

Case: Cruise terminal feasibility analysis

Location: Texas, USA

Challenge: The port is one of the two largest energy ports in the country. Interested in diversifying its revenue streams, the Port of Corpus Christi desired to have a feasibility analysis for the development of a cruise terminals at two specific sites within the Corpus Christi harbour area.

Solution: A comprehensive assessment of the Gulf Coast cruise market and its dynamics was conducted, along with a financial analysis of potential revenue streams that this might generate. The cruise market analysis included analysing of the requisite transportation infrastructure for passengers, potential market catchment areas, and existing port-of-calls and home ports in the Gulf of Mexico, along with potential cruise line requirements and future cruise ship sizes and average fleet growth to determine the potential for home porting at Corpus Christi. The feasibility study also included a return/risk analysis and forecast of revenues compared to potential development costs measured against existing cargo types.

The Net Results: The port received a comprehensive assessment of all factors related to determining the potential financial, market, and stakeholder returns for a potential cruise terminal benchmarked against pre-determined industry and internal target thresholds. The net result of the analysis was that the market catchment area would not support a home port for a ship of any significant size, the access to the potential cruise terminal facility was not adequate (air, road), and the existing cruise terminals in the Gulf of Mexico represented existing and future passenger and terminal capacity represented a significant degree of competition (ie, Galveston, New Orleans, Mobile, Tampa) that would make a cruise terminal at Corpus Christi financially infeasible and far too risk laden, particularly when compared to the revenue streams generated by liquid bulk energy cargo.

Case: Valuation of a confiscated port facility

Location: Not disclosed

Challenge: The owners of a long-term port terminal concession, for what was the most important port facility in at the time of confiscation 60-years ago which today is the main cruise ship terminal in country, filed suit against certain users of the facility under Helms – Burton Act (aka Libertad Act). There was little precedence to guide the parties to the suit. Travel was not possible for on-site inspections and information and data was difficult to attain. Aegir was appointed as the lead port property adviser to frame the valuation argument, conduct the income approach to value, and form a team of consultants from the fields of engineering, cost surveyors, and appraisal methodology.

Solution: Under the act, there were two formulae’s that could be followed to establish damages or value. One was pre-defined in the act and the other was to follow general practices in valuation methodology. Aegir and the team of consultants were instructed to undertake the latter, which presented numerous complex issues to address.

The Net Results: During the case attorneys decided it would be more prudent to follow the pre-defined formulae. The case went to trial and the lawyers' clients prevailed. Damages in the amount of several hundreds of millions of US dollars. Comprehensive value assessments were developed using the two approaches to value (income and replacement costs).

Case: Valuation of a confiscated port facility

Location: Not disclosed

Challenge: The owners of a long-term port terminal concession, for what was the most important port facility in at the time of confiscation 60-years ago which today is the main cruise ship terminal in country, filed suit against certain users of the facility under Helms – Burton Act (aka Libertad Act). There was little precedence to guide the parties to the suit. Travel was not possible for on-site inspections and information and data was difficult to attain. Aegir was appointed as the lead port property adviser to frame the valuation argument, conduct the income approach to value, and form a team of consultants from the fields of engineering, cost surveyors, and appraisal methodology.

Solution: Under the act, there were two formulae’s that could be followed to establish damages or value. One was pre-defined in the act and the other was to follow general practices in valuation methodology. Aegir and the team of consultants were instructed to undertake the latter, which presented numerous complex issues to address.

The Net Results: During the case attorneys decided it would be more prudent to follow the pre-defined formulae. The case went to trial and the lawyers' clients prevailed. Damages in the amount of several hundreds of millions of US dollars. Comprehensive value assessments were developed using the two approaches to value (income and replacement costs).

Case: Strategic off port expansion plan

Location: California, USA

Challenge: The Port of Hueneme is a successful niche port (perishables, automotive ro ro, bulk and break bulk), and the only deep-water port between San Francisco and San Pedro Bay (Los Angeles/Long Beach).

Another challenge is that the port authority and its clients consistently operate at more than 100% of their land capacity, on and off port. This not a sustainable long-term. To ensure growth and viability, the port needs to increase its on port cargo velocity and throughput and expand its off-port land banks to meet its client needs and become an even greater economic engine for the community.

In this regard, the port is a major logistics centre for perishables, particularly bananas. The latter cargo is going through a transition from being transported in pallets to refrigerated containers, which will require more space on and off port for more refrigerated container yards.

A major challenge to off port expansion is that Ventura County has extensive agricultural lands, which comprise about two-thirds of the county. These lands are protected in use for decades to come through a restricted agricultural use known as SOAR (ie, Save Our Agricultural Resources). Therefore, land for industrial development is scarce. Additionally, even by California standards, the Ventura County development entitlement process is a strenuous and long process, often without any guarantees for success.

Solution: A comprehensive assessment of all available industrial land in Ventura County was conducted. Through port client interviews, key location criteria were identified, which prioritized which sites to pursue. Extensive development analysis was required due to the stringent development entitlement regulations that need to be met.

The Net Results: The result to date is that three sites are being negotiated. The largest is a 260-acre site located 2.4 miles east of the port’s central gate. A development plan was developed to create a port centric logistics park, inclusive of a private public partnership structure to place the project once entitlements are obtained, resulting in the port having an equity interest, the management of the park (whose port centric use will be guaranteed in perpetuity through a restrictive covenant deed), significant increased cargo capacity, and what is estimated to be the largest positive environmental impact to Venture County through developing the park to Platinum or Gold LEED standards and the resulting removal of truck traffic through the county and increased rail usage in the intermodal mix.

Case: Strategic off port expansion plan

Location: California, USA

Challenge: The Port of Hueneme is a successful niche port (perishables, automotive ro ro, bulk and break bulk), and the only deep-water port between San Francisco and San Pedro Bay (Los Angeles/Long Beach).

Another challenge is that the port authority and its clients consistently operate at more than 100% of their land capacity, on and off port. This not a sustainable long-term. To ensure growth and viability, the port needs to increase its on port cargo velocity and throughput and expand its off-port land banks to meet its client needs and become an even greater economic engine for the community.

In this regard, the port is a major logistics centre for perishables, particularly bananas. The latter cargo is going through a transition from being transported in pallets to refrigerated containers, which will require more space on and off port for more refrigerated container yards.

A major challenge to off port expansion is that Ventura County has extensive agricultural lands, which comprise about two-thirds of the county. These lands are protected in use for decades to come through a restricted agricultural use known as SOAR (ie, Save Our Agricultural Resources). Therefore, land for industrial development is scarce. Additionally, even by California standards, the Ventura County development entitlement process is a strenuous and long process, often without any guarantees for success.

Solution: A comprehensive assessment of all available industrial land in Ventura County was conducted. Through port client interviews, key location criteria were identified, which prioritized which sites to pursue. Extensive development analysis was required due to the stringent development entitlement regulations that need to be met.

The Net Results: The result to date is that three sites are being negotiated. The largest is a 260-acre site located 2.4 miles east of the port’s central gate. A development plan was developed to create a port centric logistics park, inclusive of a private public partnership structure to place the project once entitlements are obtained, resulting in the port having an equity interest, the management of the park (whose port centric use will be guaranteed in perpetuity through a restrictive covenant deed), significant increased cargo capacity, and what is estimated to be the largest positive environmental impact to Venture County through developing the park to Platinum or Gold LEED standards and the resulting removal of truck traffic through the county and increased rail usage in the intermodal mix.

Case: Grant Proposal - $100 million USDOT intermodal efficiency, port real estate perspective

Location: Alabama, USA

Challenge: The Alabama Port Authority, in conjunction with the Mobile Airport Authority, were bidding for a $100 million USDOT grant intended to enhance the intermodal efficiency of freight movements by air, road, and water.

Solution: To enhance its chances in winning the grant, the port and airport retained a major engineering company to assist in writing the grant proposal. The engineering company reached out to Aegir to address property related issues, intermodal strategies, and efficiencies.

Aegir was instructed to assess the competitive port centric property market with a particular focus on distribution centre inventory and land for potential development. All of which was assessed from a regional need’s standpoint relative to intermodal cargo processing capacity and support industrial space at other major Gulf Coast ports.

Aegir analysis identified major intermodal opportunities for the Port of Mobile based on several factors. First, unlike New Orleans, Houston, and Tampa, Mobile has significant industrially zoned, relatively inexpensive, land banks near the port and future airport for the development of major logistics parks. Second, Mobile is uncongested from a traffic standpoint compared to those other port centric areas. Third, the then recently announced CP – Kansas City railroad merger would result in rail access across Canada, south through the United States following the Mississippi River and then to Monterey, Mexico. This North American rail corridor runs through Mobile and its connectivity to five, Class 1 railroads. Fourth, with the expansion of the Panama Canal and existing and future pressure on West Coast gateway ports, the Port of Mobile offers an attractive alternative to the ‘four corners’ (ie, Pacific Northwest, Southern California, New England and Mid-Atlantic) distribution strategy. And fifth, the Mobile area already has extensive intermodal infrastructure in place that is being expanded.

All of which would results in the Mobile area having the potential of becoming a major intermodal and multimodal logistics platform, one that would have wide scale positive ramifications for the US economy. The grant would go far in converting the Port of Mobile into the next Gulf Coast gateway port.

The Net Results: The Alabama Port Authority and the Mobile Airport Authority were successful in being awarded the grant.

Case: Grant Proposal - $100 million USDOT intermodal efficiency, port real estate perspective

Location: Alabama, USA

Challenge: The Alabama Port Authority, in conjunction with the Mobile Airport Authority, were bidding for a $100 million USDOT grant intended to enhance the intermodal efficiency of freight movements by air, road, and water.

Solution: To enhance its chances in winning the grant, the port and airport retained a major engineering company to assist in writing the grant proposal. The engineering company reached out to Aegir to address property related issues, intermodal strategies, and efficiencies.

Aegir was instructed to assess the competitive port centric property market with a particular focus on distribution centre inventory and land for potential development. All of which was assessed from a regional need’s standpoint relative to intermodal cargo processing capacity and support industrial space at other major Gulf Coast ports.

Aegir analysis identified major intermodal opportunities for the Port of Mobile based on several factors. First, unlike New Orleans, Houston, and Tampa, Mobile has significant industrially zoned, relatively inexpensive, land banks near the port and future airport for the development of major logistics parks. Second, Mobile is uncongested from a traffic standpoint compared to those other port centric areas. Third, the then recently announced CP – Kansas City railroad merger would result in rail access across Canada, south through the United States following the Mississippi River and then to Monterey, Mexico. This North American rail corridor runs through Mobile and its connectivity to five, Class 1 railroads. Fourth, with the expansion of the Panama Canal and existing and future pressure on West Coast gateway ports, the Port of Mobile offers an attractive alternative to the ‘four corners’ (ie, Pacific Northwest, Southern California, New England and Mid-Atlantic) distribution strategy. And fifth, the Mobile area already has extensive intermodal infrastructure in place that is being expanded.

All of which would results in the Mobile area having the potential of becoming a major intermodal and multimodal logistics platform, one that would have wide scale positive ramifications for the US economy. The grant would go far in converting the Port of Mobile into the next Gulf Coast gateway port.

The Net Results: The Alabama Port Authority and the Mobile Airport Authority were successful in being awarded the grant.

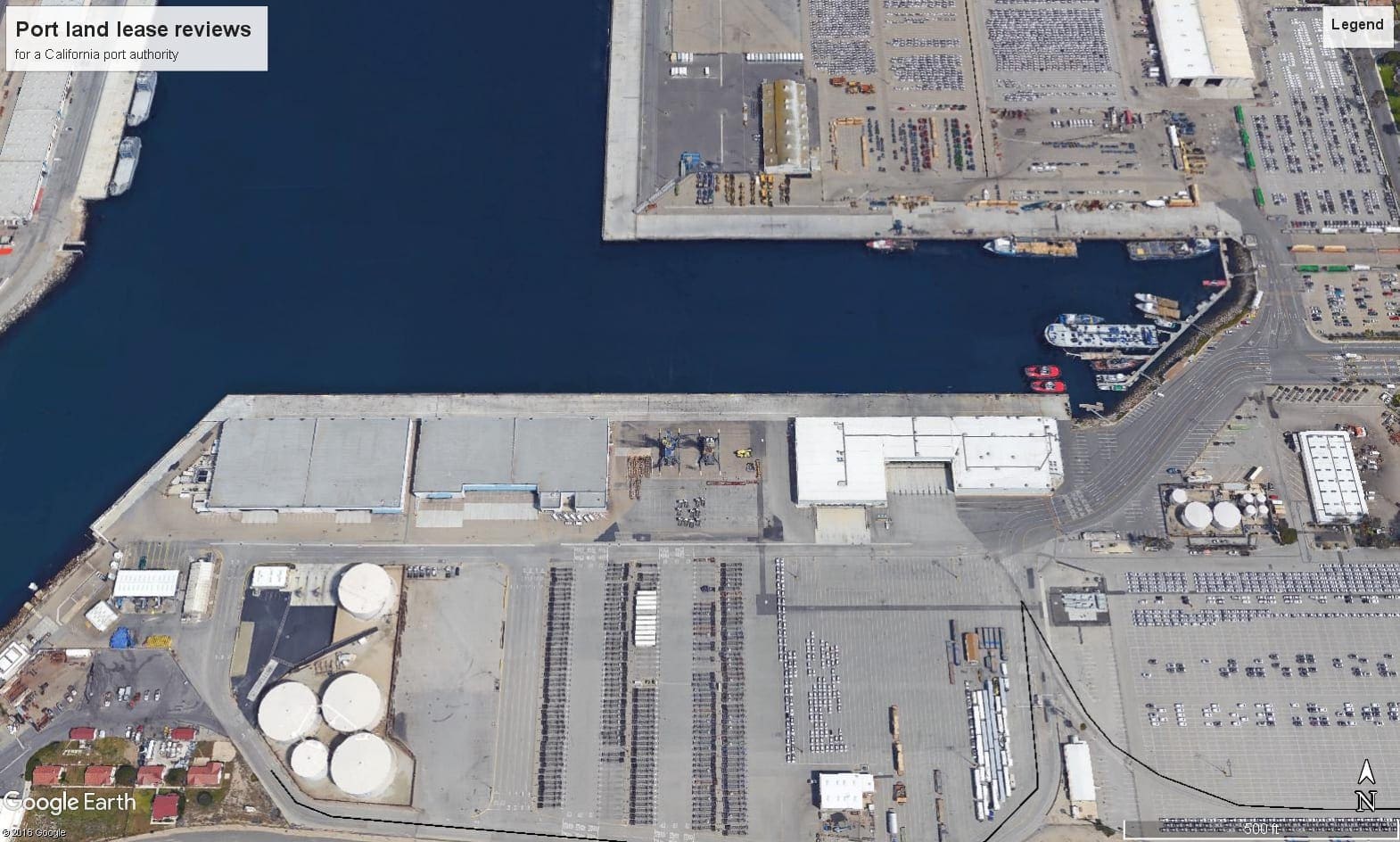

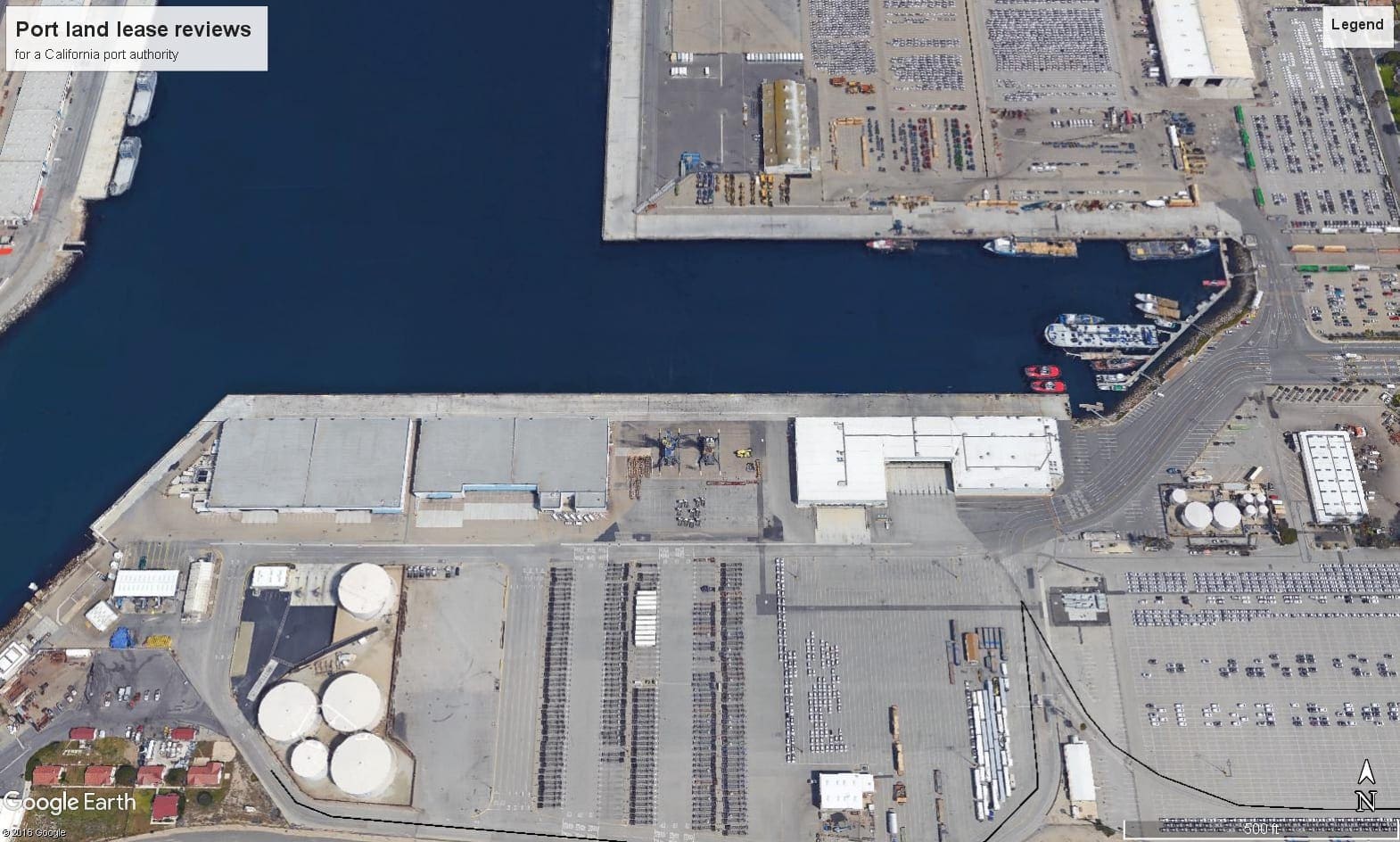

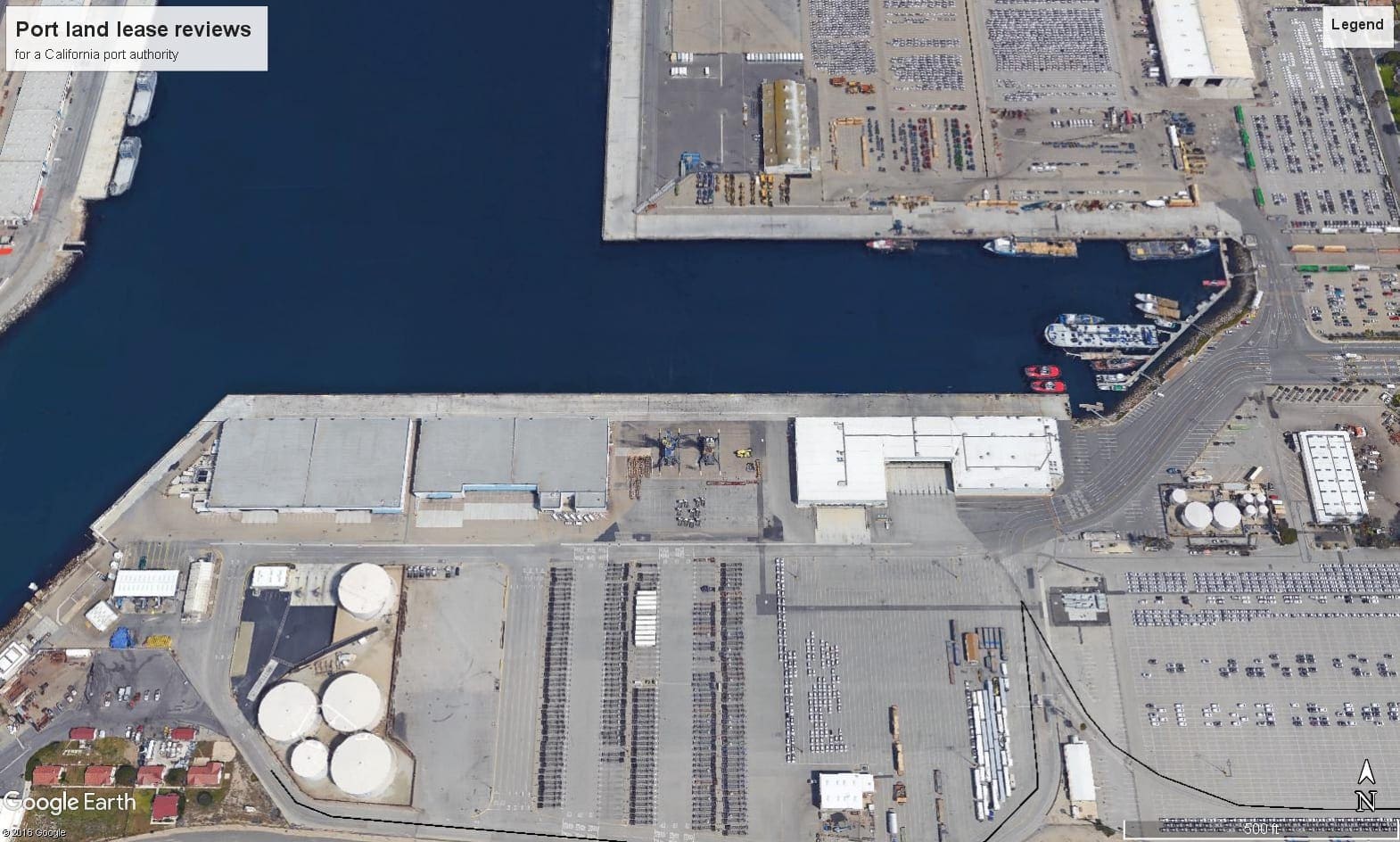

Case: Port land lease reviews

Location: USA

Challenge: A major tract of near dock land behind a terminal was coming up for rent reviews. Additionally, a large port owned industrial tract located off port but under a port related use was also coming up for rent review as well. The port director felt current rental rates for both sites were under ‘market’ but had no way of gauging this locally.

Solution: Aegir was engaged to undertake a comprehensive assessment of the two sites, the general market conditions for industrial land in the region and land at comparable port facilities and uses and determine what the ‘market’ rents should be for both.

Through a combination of in depth local and like kind port market and property analyses and using established valuation approaches market values and corresponding lease rates were established and corroborated resulting in lease more than fifty percent of existing ones.

The Net Results: Through a combination of in depth local and like kind port market and property analyses and using established valuation approaches market values and corresponding lease rates were established and corroborated resulting in lease more than fifty percent of existing ones.

Case: Port land lease reviews

Location: USA

Challenge: A major tract of near dock land behind a terminal was coming up for rent reviews. Additionally, a large port owned industrial tract located off port but under a port related use was also coming up for rent review as well. The port director felt current rental rates for both sites were under ‘market’ but had no way of gauging this locally.

Solution: Aegir was engaged to undertake a comprehensive assessment of the two sites, the general market conditions for industrial land in the region and land at comparable port facilities and uses and determine what the ‘market’ rents should be for both.

Through a combination of in depth local and like kind port market and property analyses and using established valuation approaches market values and corresponding lease rates were established and corroborated resulting in lease more than fifty percent of existing ones.

The Net Results: Through a combination of in depth local and like kind port market and property analyses and using established valuation approaches market values and corresponding lease rates were established and corroborated resulting in lease more than fifty percent of existing ones.

Case: Valuation & consulting: fee simple and leasehold interests – inland bulk terminals

Location: USA

Challenge: Major steel company was looking to determine a market value lease rate, terms and conditions for the renewal of a lease for a bulk terminal located on a major inland waterway for lease negotiations. After several discussions with local, traditional appraisers, they realized the market dynamics for this type of asset were different than what they were being told, as the value ranges being discussed were not correlating with their investment in the facility and the supply/demand factors for this type of asset and other relevant issues.

Solution: Undertook an income, replacement, developer’s residual method and comparable approaches to valuation. With results, could advise the client on value and lease rate terms and conditions.

The Net Results: Client could present to their tenant a substantiated case as to the lease rate terms and conditions for the asset, which was considerably higher than what they had been paying. Tenant accepted results of the study and renewed the lease.

Case: Valuation & consulting: fee simple and leasehold interests – inland bulk terminals

Location: USA

Challenge: Major steel company was looking to determine a market value lease rate, terms and conditions for the renewal of a lease for a bulk terminal located on a major inland waterway for lease negotiations. After several discussions with local, traditional appraisers, they realized the market dynamics for this type of asset were different than what they were being told, as the value ranges being discussed were not correlating with their investment in the facility and the supply/demand factors for this type of asset and other relevant issues.

Solution: Undertook an income, replacement, developer’s residual method and comparable approaches to valuation. With results, could advise the client on value and lease rate terms and conditions.

The Net Results: Client could present to their tenant a substantiated case as to the lease rate terms and conditions for the asset, which was considerably higher than what they had been paying. Tenant accepted results of the study and renewed the lease.

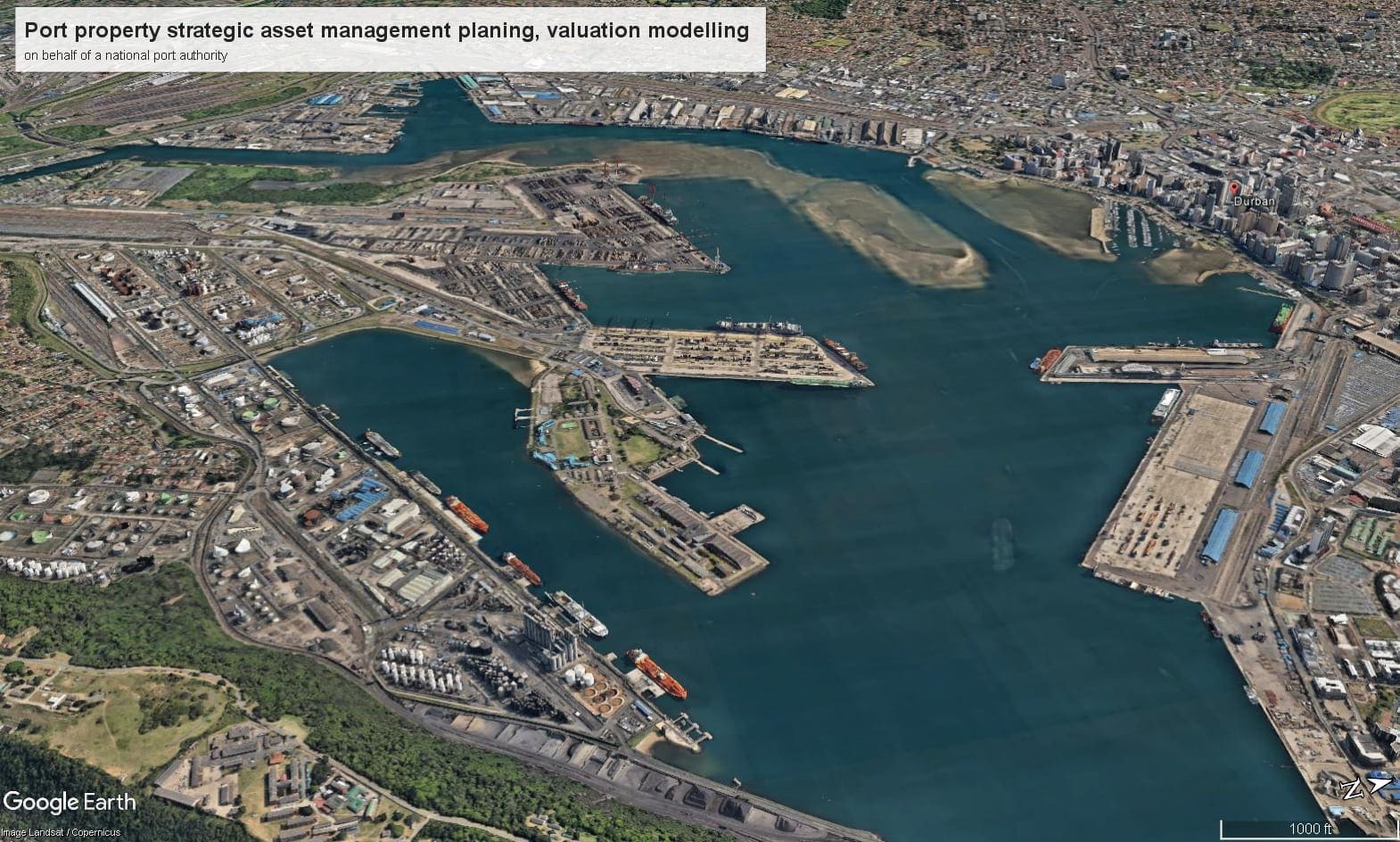

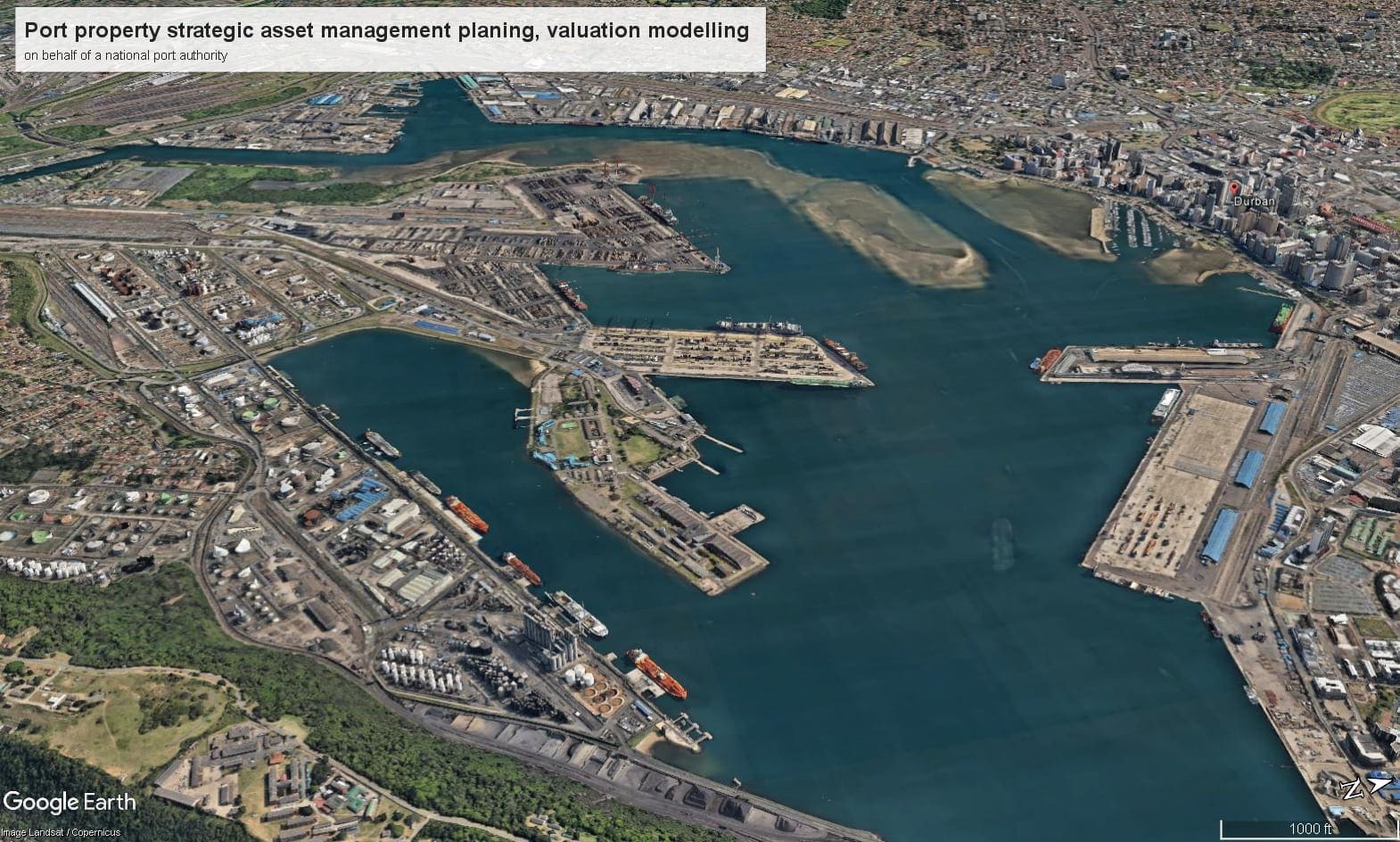

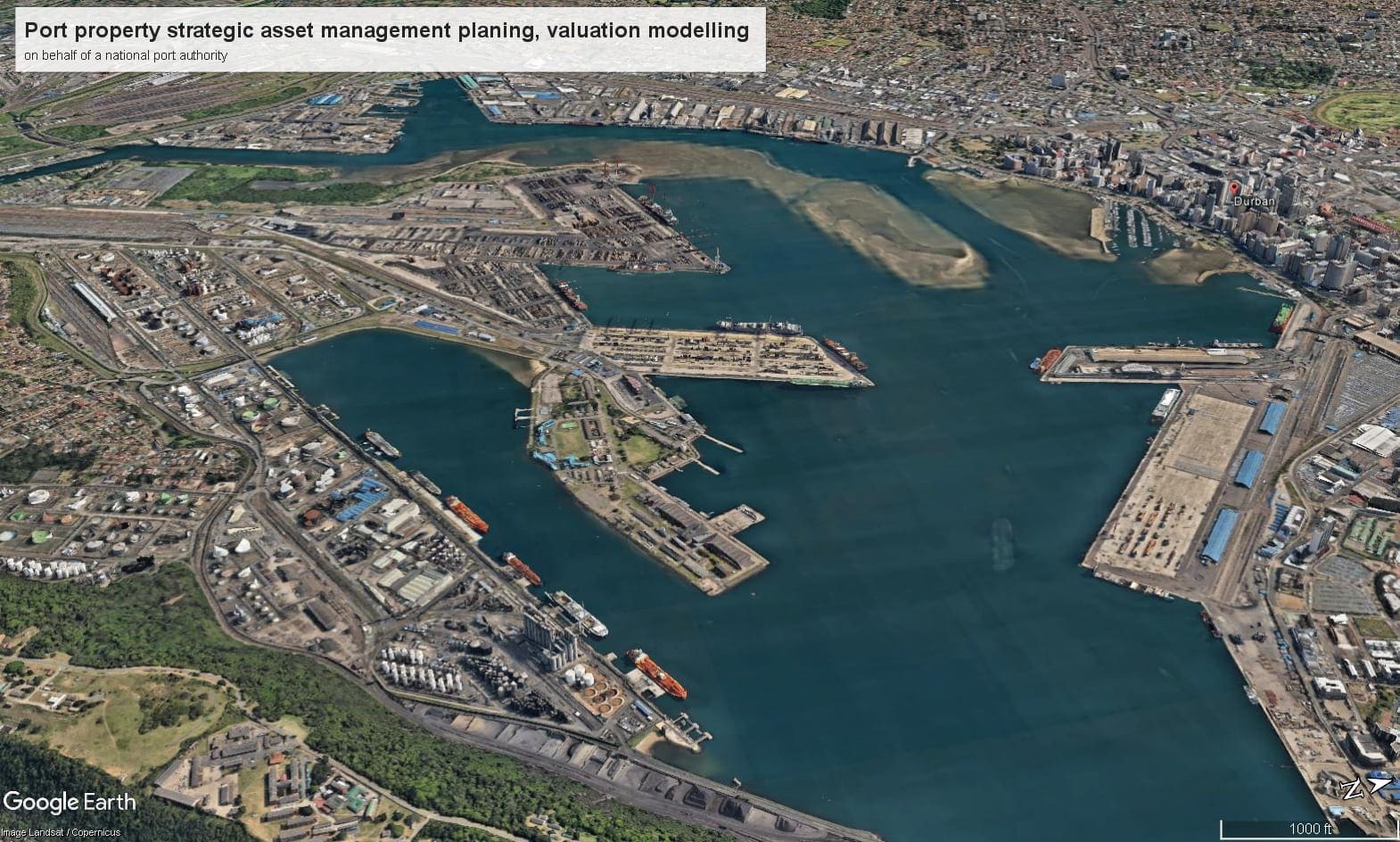

Case: Strategic port property asset management plan

Location: Africa

Challenge: A national port authority with an extensive port property portfolio throughout eight ports looking to institute a plan to more effectively manage the expansive portfolio, structure meaningful lease rates and benchmark asset value enhancement success.

Solution: Conduct a comprehensive analysis of existing management policies and practices, review lease documents and leases, develop strategic port property asset management plan and port property valuation model.

The Net Results: Identification of existing management policy shortcomings, development of port property valuation model to easily benchmark property values, attain savings in lease administration software and have meaningful property management efficiencies.

Case: Strategic port property asset management plan

Location: Africa

Challenge: A national port authority with an extensive port property portfolio throughout eight ports looking to institute a plan to more effectively manage the expansive portfolio, structure meaningful lease rates and benchmark asset value enhancement success.

Solution: Conduct a comprehensive analysis of existing management policies and practices, review lease documents and leases, develop strategic port property asset management plan and port property valuation model.

The Net Results: Identification of existing management policy shortcomings, development of port property valuation model to easily benchmark property values, attain savings in lease administration software and have meaningful property management efficiencies.

Case: Port related cold storage acquisition feasibility analysis

Location: Southern California

Challenge: Port that also owns the rail beltline was looking to diversify its off-port holdings in property investments that would generate cargo and higher usage of the railroad. The port has a growing perishables trade. The identified a cold storage facility adjacent to the rail line for sale and asked Aegir to analyse this as a potential acquisition. Some of the challenges were that the facility had reached end of economic life, the asking price was, on the surface, elevated, and the dynamics of cold storage development were such that speculative development was not an option.

Opportunities: The cold storage market in the US has less than a one percent vacancy, demand for industrial development sites in Southern California that are ‘shovel ready’ are difficult to come by; rental rates are high making new development feasible. Adding cold storage capacity in the port catchment area would allow for the processing of more perishable cargo for import and export.

Solution: A comprehensive analysis of the market extending the catchment are to adjacent counties was conducted which identified that cold storage areas in the more developed, denser locations were facing economic obsolescence (i.e., alternative uses on the land would render higher economic utility than cold storage was), which indicated that there would be strong demand for these types of facilities in the location of the subject property. Development pro forma analysis at market rental rates would support development at near the asking price for the facility as a development site. All of which allowed for a purchase price approximating the asking price.

The Net Results: The port was the successful bidder for the property.

Case: Port related cold storage acquisition feasibility analysis

Location: Southern California

Challenge: Port that also owns the rail beltline was looking to diversify its off-port holdings in property investments that would generate cargo and higher usage of the railroad. The port has a growing perishables trade. The identified a cold storage facility adjacent to the rail line for sale and asked Aegir to analyse this as a potential acquisition. Some of the challenges were that the facility had reached end of economic life, the asking price was, on the surface, elevated, and the dynamics of cold storage development were such that speculative development was not an option.

Opportunities: The cold storage market in the US has less than a one percent vacancy, demand for industrial development sites in Southern California that are ‘shovel ready’ are difficult to come by; rental rates are high making new development feasible. Adding cold storage capacity in the port catchment area would allow for the processing of more perishable cargo for import and export.

Solution: A comprehensive analysis of the market extending the catchment are to adjacent counties was conducted which identified that cold storage areas in the more developed, denser locations were facing economic obsolescence (i.e., alternative uses on the land would render higher economic utility than cold storage was), which indicated that there would be strong demand for these types of facilities in the location of the subject property. Development pro forma analysis at market rental rates would support development at near the asking price for the facility as a development site. All of which allowed for a purchase price approximating the asking price.

The Net Results: The port was the successful bidder for the property.

Case: Port Authority – port master plan; port property section

Location: USA

Challenge: Under rapidly changing market conditions assisting a global engineering company to better identify challenges, identify opportunities and develop solutions to better manage the future of a 3,000-acre, privately owned, voluntary port overlay zone area that clearly was increasingly becoming feasible development sites for non-port uses.

Solution: Identify real (versus perceived) issues with the voluntary port overlay zone, as it relates to the port; assess the real property needs for the port in the next twenty years; develop an alternative development plan for the area to be presented to the municipality for approval of a new, smaller, port area but with more definitive port related uses.

The Net Results: The port could protect the strategic areas surrounding it for port related uses that would serve its expansion needs for decades to come.

Case: Port Authority – port master plan; port property section

Location: USA

Challenge: Under rapidly changing market conditions assisting a global engineering company to better identify challenges, identify opportunities and develop solutions to better manage the future of a 3,000-acre, privately owned, voluntary port overlay zone area that clearly was increasingly becoming feasible development sites for non-port uses.

Solution: Identify real (versus perceived) issues with the voluntary port overlay zone, as it relates to the port; assess the real property needs for the port in the next twenty years; develop an alternative development plan for the area to be presented to the municipality for approval of a new, smaller, port area but with more definitive port related uses.

The Net Results: The port could protect the strategic areas surrounding it for port related uses that would serve its expansion needs for decades to come.

Case: Port and related logistics park development feasibility analysis

Location: USA

Challenge: Institutional investor acquires one of the largest waterfront industrial sites in the developed world at auction; while seeking a ‘highest and best use’ analysis, from a ports, logistics and maritime standpoint, is confronted with the real possibility of an eminent domain action by the municipality.

Solution: Conduct a comprehensive assessment of the site from a maritime and logistics standpoint; identify potential land uses, values and target users; in conjunction with legal counsel, assess business ramifications of potential eminent domain action; conduct a cost-benefit-risk analysis for defending against a ‘quick take’ action and developing the site or engaging in a friendly ‘quick take’ action with the municipality.

The Net Results: The investors were given the necessary analyses and advice with which to decide to sell the site for substantial gains with a short-term holding period and have the necessary information with which to more effectively negotiate a sales price.

Case: Port and related logistics park development feasibility analysis

Location: USA

Challenge: Institutional investor acquires one of the largest waterfront industrial sites in the developed world at auction; while seeking a ‘highest and best use’ analysis, from a ports, logistics and maritime standpoint, is confronted with the real possibility of an eminent domain action by the municipality.

Solution: Conduct a comprehensive assessment of the site from a maritime and logistics standpoint; identify potential land uses, values and target users; in conjunction with legal counsel, assess business ramifications of potential eminent domain action; conduct a cost-benefit-risk analysis for defending against a ‘quick take’ action and developing the site or engaging in a friendly ‘quick take’ action with the municipality.

The Net Results: The investors were given the necessary analyses and advice with which to decide to sell the site for substantial gains with a short-term holding period and have the necessary information with which to more effectively negotiate a sales price.

Case: Encroachment damage assessment for potential aggregates terminal

Location: USA

Challenge: Private terminal operator is looking to develop an aggregates terminal on a deep water inland waterway. A major six lane, elevated bridge is built and the pilings encroach on client’s fee simple submerged land holdings (granted through a Royal Grant dating back the 1630’s), interests which were unbeknownst to the bridge developers at the time, which will significantly impact the client’s ability to load Post Panamax bunker carriers and render this use for the site unfeasible.

Solution: Retained to conduct ‘highest and best use’ study, inclusive of potential revenue streams, to be used by local appraiser in their valuation of the site, which was to be used in court.

The Net Results: The maritime related impact on the value of the site was analyzed and presented in a way that it was readily understood by the client’s local appraiser and the court.

Case: Encroachment damage assessment for potential aggregates terminal

Location: USA

Challenge: Private terminal operator is looking to develop an aggregates terminal on a deep water inland waterway. A major six lane, elevated bridge is built and the pilings encroach on client’s fee simple submerged land holdings (granted through a Royal Grant dating back the 1630’s), interests which were unbeknownst to the bridge developers at the time, which will significantly impact the client’s ability to load Post Panamax bunker carriers and render this use for the site unfeasible.

Solution: Retained to conduct ‘highest and best use’ study, inclusive of potential revenue streams, to be used by local appraiser in their valuation of the site, which was to be used in court.

The Net Results: The maritime related impact on the value of the site was analyzed and presented in a way that it was readily understood by the client’s local appraiser and the court.

Case: Port Authority – port related logistics park development highest and best use, financial and market feasibility analyses and development recommendations

Location: Caribbean

Challenge: Large tract of land adjacent to the port was being awarded to the port authority by the central government for the development of a logistics park. The feasibility of such a project was needed to be established, along with financing alternatives, if any, considering that the island country in question had experienced 16 quarters of economic contraction.

Solution: An existing development plan was created meeting the perceived needs of the commercial marketplace rather than the port centric one. Neither the government nor port had funds available for the development of the logistic park and the size of the precluded it from being developed in one phase.

A comprehensive analysis of the local commercial and industrial marketplace was undertaken to gauge demand and absorption for different types of space. An analysis of the maritime segment was also conducted to identify maritime uses and specialist port related facilities. Development phases based on potential demand, development costs and challenges (the area is in an earthquake zone and is reclaimed land, making construction of any facility expensive) were established.

Project was reworked to produce a more port centric logistics park to be built in pods of ten acres. National pension funds were interviewed for their potential interest in investing and financing such a project; the project was received with significant positive interest. A required connector between the port and the park was changed from a tunnel (due to the nature of the subsoil) to a bridge which would be financed through tolls.

The Net Results: the potential attainment of an almost double digit return for the port authority on ‘market’ capital values for the land with no money invested by either the port or the central government through a combination of PPP joint ventures between port users, pension funds and the port authority.

Case: Port Authority – port related logistics park development highest and best use, financial and market feasibility analyses and development recommendations

Location: Caribbean

Challenge: Large tract of land adjacent to the port was being awarded to the port authority by the central government for the development of a logistics park. The feasibility of such a project was needed to be established, along with financing alternatives, if any, considering that the island country in question had experienced 16 quarters of economic contraction.

Solution: An existing development plan was created meeting the perceived needs of the commercial marketplace rather than the port centric one. Neither the government nor port had funds available for the development of the logistic park and the size of the precluded it from being developed in one phase.

A comprehensive analysis of the local commercial and industrial marketplace was undertaken to gauge demand and absorption for different types of space. An analysis of the maritime segment was also conducted to identify maritime uses and specialist port related facilities. Development phases based on potential demand, development costs and challenges (the area is in an earthquake zone and is reclaimed land, making construction of any facility expensive) were established.

Project was reworked to produce a more port centric logistics park to be built in pods of ten acres. National pension funds were interviewed for their potential interest in investing and financing such a project; the project was received with significant positive interest. A required connector between the port and the park was changed from a tunnel (due to the nature of the subsoil) to a bridge which would be financed through tolls.

The Net Results: the potential attainment of an almost double digit return for the port authority on ‘market’ capital values for the land with no money invested by either the port or the central government through a combination of PPP joint ventures between port users, pension funds and the port authority.

Case: Highest and Best Use’ & revenue analysis – on dock inter modal facility.

Location: East Coast US

Challenge: Fund owned two large tracts of land earmarked for luxury planned unit developments. The onset of the Great Recession made this type of development unfeasible. Client was looking for alternative use for the sites which were located adjacent to major port facilities.

Solution: A comprehensive analysis of the maritime and cargo market was undertaken along with a SWOT analysis of the port in question. This identified as a lack of on and near dock inter modal capabilities significantly negatively impacting this port facility, a function which both sites could easily take on.

The Net Results: A comprehensive market and financial analyses, inclusive of projected revenue streams and pricing for services, was undertaken for two major inter modal projects. Based on the results of the analysis, the designs for the proposed projects were changed to attain millions in capital expenditures. The projected internal rate of return estimates, which were extensively corroborated with market data and analysis, exceeded the pension fund’s established financial and timing thresholds. Both projects were approved by the pension’s investment committee in a collective amount exceeding $800 million.

Case: Highest and Best Use’ & revenue analysis – on dock inter modal facility.

Location: East Coast US

Challenge: Fund owned two large tracts of land earmarked for luxury planned unit developments. The onset of the Great Recession made this type of development unfeasible. Client was looking for alternative use for the sites which were located adjacent to major port facilities.

Solution: A comprehensive analysis of the maritime and cargo market was undertaken along with a SWOT analysis of the port in question. This identified as a lack of on and near dock inter modal capabilities significantly negatively impacting this port facility, a function which both sites could easily take on.

The Net Results: A comprehensive market and financial analyses, inclusive of projected revenue streams and pricing for services, was undertaken for two major inter modal projects. Based on the results of the analysis, the designs for the proposed projects were changed to attain millions in capital expenditures. The projected internal rate of return estimates, which were extensively corroborated with market data and analysis, exceeded the pension fund’s established financial and timing thresholds. Both projects were approved by the pension’s investment committee in a collective amount exceeding $800 million.

Case: Port Authority – port property value enhancement, port stakeholder community development

Location: Caribbean

Challenge: Port authority was looking to enhance the value of land holdings, and a substantial wharf located in an historic district several hundred years old. The district had experienced significant depopulation through urban flight and sprawl. The only effective way to enhance the port’s asset values was to redevelop the district in a concerted and planned fashion.

Solution: A ‘hub and spoke’ urban re-development plan was developed, major anchor landlords were identified and contacted, an urban planning studio with extensive experience in ‘hard and soft’ port and urban waterfront planning was retained and in conjunction with the urban planners a strategic and financial re-development plan for the district was created. This plan included such strategies as connecting four distinctly different and separated tourist areas with a hybrid diesel trolley system; structuring loan guarantees from the Central Bank and the European Union for soft re-development loans for individual property owners; creating a local community support initiative for the projects; and obtaining commitments for the re-development of key anchor parcels with the district by the anchor major landlords.

The Net Results: The plan was presented to the community and addressed every major issue that the port’s shareholders and stakeholders had and was widely and robustly accepted by the community at large.

Case: Port Authority – port property value enhancement, port stakeholder community development

Location: Caribbean

Challenge: Port authority was looking to enhance the value of land holdings, and a substantial wharf located in an historic district several hundred years old. The district had experienced significant depopulation through urban flight and sprawl. The only effective way to enhance the port’s asset values was to redevelop the district in a concerted and planned fashion.

Solution: A ‘hub and spoke’ urban re-development plan was developed, major anchor landlords were identified and contacted, an urban planning studio with extensive experience in ‘hard and soft’ port and urban waterfront planning was retained and in conjunction with the urban planners a strategic and financial re-development plan for the district was created. This plan included such strategies as connecting four distinctly different and separated tourist areas with a hybrid diesel trolley system; structuring loan guarantees from the Central Bank and the European Union for soft re-development loans for individual property owners; creating a local community support initiative for the projects; and obtaining commitments for the re-development of key anchor parcels with the district by the anchor major landlords.

The Net Results: The plan was presented to the community and addressed every major issue that the port’s shareholders and stakeholders had and was widely and robustly accepted by the community at large.

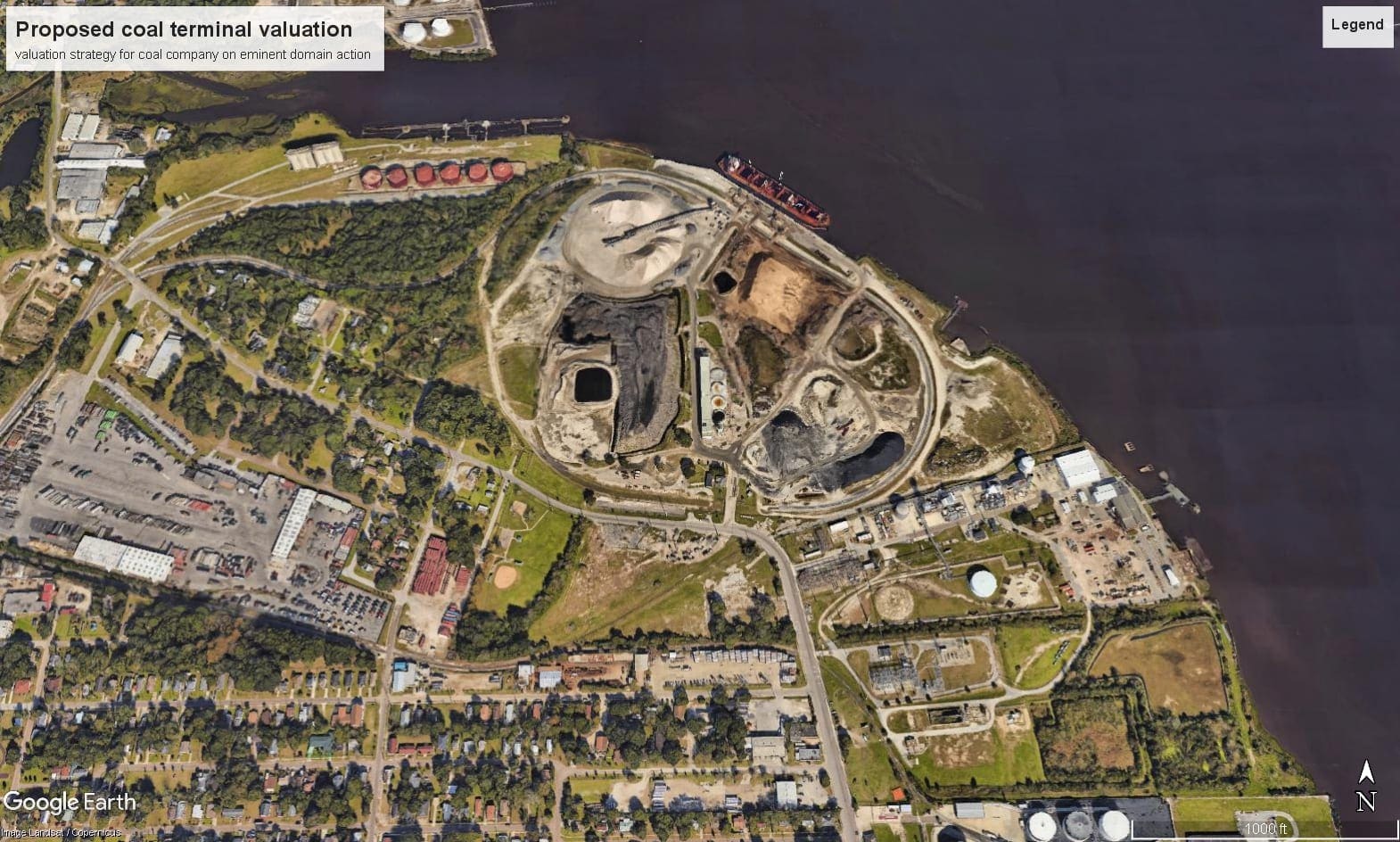

Case: Expert witness - Valuation strategy for coal company on eminent domain action

Location: Jacksonville, Florida

Challenge: Port of Jacksonville institutes a takeover action through eminent domain powers for a recently acquired 70-acre potential coal terminal.

Solution: A valuation strategy and argument were framed incorporating various approaches to value and the impact of numerous factors on East Coast port lands such as the expansion of the Panama Canal. The net result was the highest eminent domain award to the client in the history of the State of Florida.

The Net Results: The highest eminent domain jury award in the history of the State of Florida – more than $67 million.

Case: Expert witness - Valuation strategy for coal company on eminent domain action

Location: Jacksonville, Florida

Challenge: Port of Jacksonville institutes a takeover action through eminent domain powers for a recently acquired 70-acre potential coal terminal.

Solution: A valuation strategy and argument were framed incorporating various approaches to value and the impact of numerous factors on East Coast port lands such as the expansion of the Panama Canal. The net result was the highest eminent domain award to the client in the history of the State of Florida.

The Net Results: The highest eminent domain jury award in the history of the State of Florida – more than $67 million.

Case: Strategic port property asset management plan, lease structuring, valuations

Location: US Inland waterways

Challenge: State port authority with various state-wide port facilities was reviewing its five-year appraisal and lease pricing process for its property portfolios. They were looking for reports and analyses that would be more relevant and usable for their pricing needs as they felt that past exercises in this regard had accomplished and added little value to their land pricing.

Solution: A review of their last appraisal reports indicated that the port authority’s pricing was based on erroneous capitalization rates based on ground lease capitalization rates for fast food restaurants. Comprehensive valuation analysis of each major port facility was undertaken and every individual land parcel.

A comprehensive review and analyses of their lease administration and asset management practices were undertaken to develop a comprehensive strategic port property asset management plan for all port facilities and the port authority in general.

Appropriate capitalization rates were developed along with a simple yet effective port pricing schedule ensuring that real returns of and on capital values would be achieved.

The Net Results: The net results were upwardly revamped lease rates at every facility and the development of an asset management plan that would make managing of port property assets more effective and simpler for port directors and senior management, benchmark financial performance and over arch the port authority’s core business strategies.

Case: Strategic port property asset management plan, lease structuring, valuations

Location: US Inland waterways

Challenge: State port authority with various state-wide port facilities was reviewing its five-year appraisal and lease pricing process for its property portfolios. They were looking for reports and analyses that would be more relevant and usable for their pricing needs as they felt that past exercises in this regard had accomplished and added little value to their land pricing.

Solution: A review of their last appraisal reports indicated that the port authority’s pricing was based on erroneous capitalization rates based on ground lease capitalization rates for fast food restaurants. Comprehensive valuation analysis of each major port facility was undertaken and every individual land parcel.

A comprehensive review and analyses of their lease administration and asset management practices were undertaken to develop a comprehensive strategic port property asset management plan for all port facilities and the port authority in general.

Appropriate capitalization rates were developed along with a simple yet effective port pricing schedule ensuring that real returns of and on capital values would be achieved.

The Net Results: The net results were upwardly revamped lease rates at every facility and the development of an asset management plan that would make managing of port property assets more effective and simpler for port directors and senior management, benchmark financial performance and over arch the port authority’s core business strategies.

Case: Port Authority – re-calibration of port’s position in the community and with clients, unions and other stakeholders.

Location: Canada

Challenge: Over the years the port authority had experienced an increasingly contentious environment between the union, terminal operators, community and the logistics sector, which was negatively impacting the interests of all concerned. This was identified as a major challenge by the incoming chief executive, who wanted to take the opportunity of a new administration to ‘re-align’ common interests, goals and objectives.

Solution: An assessment of each stakeholder’s position was done; a review of the port’s competitive position was made; surveys were undertaken to identify key issues; and extensive interviews with port staff, union members and clients were conducted. With the results and in conjunction with port senior management, a strategy was developed to ‘re-align’ the interests of all concerned through a one day port workshop open to the public. At the workshop and overview of the history of the port, its contribution over the decades to the community and its current market position and the challenges the industry and more specifically the port faced was presented. The overriding message was that if all stakeholders did not align their interests and reach a higher level of co-operation, the port would start to seriously lose market share, since the present status quo was making the port noncompetitive and unsustainable. Extensive questions and answers periods were held, along with numerous round table discussions addressing key issues and collectively addressing hypothetical case studies (reflecting reality in most cases). At one round table, union members and terminal operators were purposely seated side by side (to their great discomfort). At the end of the workshop key goals and objectives were collectively set with the key, unspoken, one being to have all concerned buy into a re-alignment and a new start for them and for the port.

The Net Results: The bringing together of port stakeholders, shareholders and the community at large had striking effects. The interdependence of each player became self-evident, with co-operation and a willingness to discuss issues in the future clearly critical, if the port was to survive. The workshop also set the stage for the clear change of course the new chief executive was going to take. Five years after the workshop, a presentation was made to the community on the progress they all had made since the workshop. The results were dramatic and a testament to the vision of the then new chief executive and the willingness of the port clients, union and the community at large to forge ahead under a newly re-aligned purpose and spirit.

Case: Port Authority – re-calibration of port’s position in the community and with clients, unions and other stakeholders.

Location: Canada

Challenge: Over the years the port authority had experienced an increasingly contentious environment between the union, terminal operators, community and the logistics sector, which was negatively impacting the interests of all concerned. This was identified as a major challenge by the incoming chief executive, who wanted to take the opportunity of a new administration to ‘re-align’ common interests, goals and objectives.

Solution: An assessment of each stakeholder’s position was done; a review of the port’s competitive position was made; surveys were undertaken to identify key issues; and extensive interviews with port staff, union members and clients were conducted. With the results and in conjunction with port senior management, a strategy was developed to ‘re-align’ the interests of all concerned through a one day port workshop open to the public. At the workshop and overview of the history of the port, its contribution over the decades to the community and its current market position and the challenges the industry and more specifically the port faced was presented. The overriding message was that if all stakeholders did not align their interests and reach a higher level of co-operation, the port would start to seriously lose market share, since the present status quo was making the port noncompetitive and unsustainable. Extensive questions and answers periods were held, along with numerous round table discussions addressing key issues and collectively addressing hypothetical case studies (reflecting reality in most cases). At one round table, union members and terminal operators were purposely seated side by side (to their great discomfort). At the end of the workshop key goals and objectives were collectively set with the key, unspoken, one being to have all concerned buy into a re-alignment and a new start for them and for the port.

The Net Results: The bringing together of port stakeholders, shareholders and the community at large had striking effects. The interdependence of each player became self-evident, with co-operation and a willingness to discuss issues in the future clearly critical, if the port was to survive. The workshop also set the stage for the clear change of course the new chief executive was going to take. Five years after the workshop, a presentation was made to the community on the progress they all had made since the workshop. The results were dramatic and a testament to the vision of the then new chief executive and the willingness of the port clients, union and the community at large to forge ahead under a newly re-aligned purpose and spirit.

Case: UK terminal leasehold valuations

Location: England

Challenge: As part of a significant corporate acquisition client acquires a once major paper and pulp distribution business with three terminals at a port in England. Although a non-core business, it had some strategic land assets which over time were sold off at substantial profit. Subsidiary starts posting increasingly large monthly operating losses and the remaining major assets left in the company are the leasehold interests in the three terminals.

Solution: Aegir is called to analyse all options. A comprehensive valuation of the leaseholds is conducted during the beginning of the Great Recession. Although the leaseholds have value, the breadth, scope and depth of the global recession effectively shuts down any potential market for the disposal of the terminal leaseholds.

An in-depth analysis of the business and the development of a turnaround strategy is developed for the client. Upon reviewing the results, it is decided that although there is the possibility of turning around the business, the growth potential in the foreseeable future for the industry does not warrant the time or investment required to turn the entity around.

An immediate winding down plan is developed whereby Aegir and Drewry offer interim management services for the entity and a planned winding down programme for the business unit is undertaken. Within six months the business is effectively shut down, assets sold and negotiations with the landlord result in a quick termination of the lease, resulting in major cost savings to the client.

The Net Results: Within six months the business is effectively shut down, assets sold and negotiations with the landlord result in a quick termination of the lease, resulting in major cost savings to the client.

Case: UK terminal leasehold valuations

Location: England

Challenge: As part of a significant corporate acquisition client acquires a once major paper and pulp distribution business with three terminals at a port in England. Although a non-core business, it had some strategic land assets which over time were sold off at substantial profit. Subsidiary starts posting increasingly large monthly operating losses and the remaining major assets left in the company are the leasehold interests in the three terminals.

Solution: Aegir is called to analyse all options. A comprehensive valuation of the leaseholds is conducted during the beginning of the Great Recession. Although the leaseholds have value, the breadth, scope and depth of the global recession effectively shuts down any potential market for the disposal of the terminal leaseholds.

An in-depth analysis of the business and the development of a turnaround strategy is developed for the client. Upon reviewing the results, it is decided that although there is the possibility of turning around the business, the growth potential in the foreseeable future for the industry does not warrant the time or investment required to turn the entity around.

An immediate winding down plan is developed whereby Aegir and Drewry offer interim management services for the entity and a planned winding down programme for the business unit is undertaken. Within six months the business is effectively shut down, assets sold and negotiations with the landlord result in a quick termination of the lease, resulting in major cost savings to the client.

The Net Results: Within six months the business is effectively shut down, assets sold and negotiations with the landlord result in a quick termination of the lease, resulting in major cost savings to the client.

Case: Port land expansion strategy and implementation

Location: USA

Challenge: Port authority and its clients were so land constrained that most were operating at almost double the design and land capacity thresholds. To continue to grow, port had to significantly increase off-port land banks. The port’s location was in area with a challenging political environment not receptive to further port expansion.

Solution: An off-port land expansion strategy was developed that highlighted the port’s main business lines as being ‘clean business; the benefits of consolidating port activities nearer to the port were presented; an innovative revenue sharing program with the predominant municipality was structured; and the beneficial economic impact of new business to the city and its citizenry detailed.

The Net Results: A more receptive political environment; potential land use changes resulting in 300 acres coming on stream for port use; and a closer worming relationship between city and port.

Case: Port land expansion strategy and implementation

Location: USA

Challenge: Port authority and its clients were so land constrained that most were operating at almost double the design and land capacity thresholds. To continue to grow, port had to significantly increase off-port land banks. The port’s location was in area with a challenging political environment not receptive to further port expansion.

Solution: An off-port land expansion strategy was developed that highlighted the port’s main business lines as being ‘clean business; the benefits of consolidating port activities nearer to the port were presented; an innovative revenue sharing program with the predominant municipality was structured; and the beneficial economic impact of new business to the city and its citizenry detailed.

The Net Results: A more receptive political environment; potential land use changes resulting in 300 acres coming on stream for port use; and a closer worming relationship between city and port.

Case: Port land expansion acquisition strategy

Location: USA

Challenge: Port authority meeting on port land capacity seeking to obtain additional land bank usage from adjacent underutilised US Navy facility.

Solution: Develop a proposal for the management of the adjacent land bank that would result in the port not having to invest capital by offering to manage and market land while still maintaining the Department of Defense’s requirement to deliver short term vacating of the site.

The Net Results: Port did not have to lay out capital and could generate revenues for the Navy and itself and better serve clients.

Case: Port land expansion acquisition strategy

Location: USA

Challenge: Port authority meeting on port land capacity seeking to obtain additional land bank usage from adjacent underutilised US Navy facility.

Solution: Develop a proposal for the management of the adjacent land bank that would result in the port not having to invest capital by offering to manage and market land while still maintaining the Department of Defense’s requirement to deliver short term vacating of the site.

The Net Results: Port did not have to lay out capital and could generate revenues for the Navy and itself and better serve clients.

Case: 2.5m teu submerged development site

Location: Canada

Challenge: In an acquisition negotiation between a port authority and the province the need arose to have a free market value for a submerged site where a 2.5 million teu terminal and railroad causeway were slated to be built. The income approach was not allowed to be used, making the valuation even more challenging. The acquiring party’s valuation was approximately ten times lower than the eventual value determined by our analyses.

Solution: An international assessment of terminals built on reclaimed land was conducted, development costs analyzed and a fair market value determined.

The Net Results: The value developed from the valuation analyses was accepted by both parties and the submerged site was sold.

Case: 2.5m teu submerged development site